What a new ACL costs

As the bills for my ACL surgery rolled in last fall, I dutifully paid my co-pay, deeply grateful for the fact that I had insurance. Sometime in early November, the PT office called to tell me that I had used up almost all of my insurance benefits for PT for 2013. The issue was ultimately resolved (I wasn’t running out of benefits), but in the course of trying to track down what my benefits were and how much I had left, the billing office admitted they had no idea how much money I had left because they had no idea how much my insurance would cover/pay for each visit.

Excuse me?

They admitted to arbitrarily inflating the amount billed knowing that the insurance company would pay some portion of it. They didn’t know anything about the reimbursement rate. Nothing.

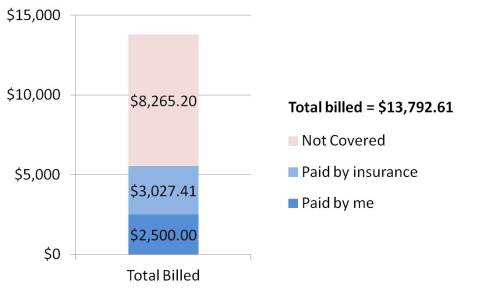

Curious, I decided to sort through my medical bills and insurance statements to see if I could figure it out. Here’s what I learned. In 2013, my medical providers billed a total of $13,792.61 for my ACL reconstruction. This includes doctor visits, medical images, physical therapy, surgery, and misc. things like crutches. (I will still do more PT in 2014, so the total number will continue to climb. It’s an interesting snapshot so far, though.)

The most astounding part of this number isn’t the total amount. That seems more or less reasonable to me. What’s most astounding is the size of the insurance company’s write-down – $8,265.20. That’s more than half of the total amount billed!

Right there, that tells me one of the biggest benefits to having insurance is simply in the actual cost. If I’d had to pay cash for my care, I doubt that I could have convinced my providers to discount their billing rates by 60%. This is especially true, if the providers themselves have no idea what insurance would pay for a particular visit or service. (See above.)

The other thing I was fascinated by was the total amount the insurance company paid – only $3,027.41. If I bought insurance on the open market (under Obamacare), a similar level of insurance would cost me $3,600 a year. I’m relatively healthy and only see a doctor every other year for a checkup. I make use of an emergency clinic maybe once a year. Acute illness – like a torn ACL – is the exact reason I think insurance is worthwhile. It turns out that even after a big surgery like mine, the insurance company is still paying out less than they take in. Huh…

Then I started looking at individual charges to see if I could figure out what the contract rates for things were. I noticed that the charge amounts seem pretty arbitrary. In one instance, the Overlake Emergency Clinic billed $400 for some x-rays. Later, my surgeon billed $92 for the exact same set of x-rays. These were written down to $138 and $42, respectively. Not only did the insurance company pay a different amount for the same set of x-rays, they paid a different percentage of the amount billed. What gives? How else would you the insurance company decide what to pay? What am I missing?

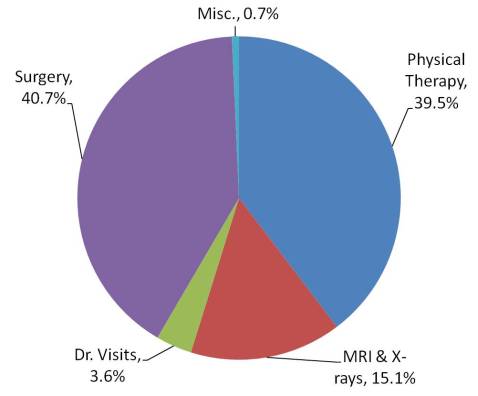

Finally, just for kicks, I totaled the cost of my care in various categories based on the allowed amounts by the insurance company. Physical therapy will easily cost more than the surgery by the time I’m done. In the mean time, the breakdown is curiously interesting.

Maybe I can shed a little light with a wall of text:

“they had no idea how much my insurance would cover/pay for each visit” – There are a couple possibilities for this. Assuming you’re still paying your deductible, insurance won’t pay a dime. Your PT office won’t know when you meet your deductible and start paying a copay since lots of other providers are also dipping into the same pot, some billing daily, some weekly, some monthly. Or, they do know but aren’t allowed to tell you. Their fee schedule is a trade secret and they can’t disclose it or maybe they’re instructed not to tell people what insurance rates are in case insurance decides to deny the claim and the patient gets stuck with a much larger bill than they expected – they then blame the provider when it’s not their fault. My receptionist tells patients “We bill $X, insurance typically pays around $Y but you should double check with them to be sure you’re covered.” CYA all the way

Paying more than you get for insurance: this is simply how it has to work. Despite having a major trauma this past year, you’re young and healthy. You are currently subsidizing people who get more than they pay. If you had a major trauma and spent a couple weeks in the ICU you’d pay a little more (depending on your maximum out of pocket) but it would cost the insurance company tens of thousands. Honestly, at this point you’re even above what the Affordable Care Act has determined is an acceptable “break even” point for insurance companies if you paid $3600/year in premiums. Insurance companies are required to pay out >80% of premiums in claims reimbursement. You’d be at 84%

Different x-ray prices: ERs charge more for everything. They have to cover their write-offs from uninsured folks who use them as a PCP and never pay. They also get to charge a “facility fee” – which is just extra money you get to pay for the privilege of being at a hospital (or hospital-owned outpatient clinic). What your insurance pays of these charge isn’t based on a percentage, it’s based on a negotiated rate. The ER department has much more leverage (it’s a hospital, lots of providers, lots of service) than your surgeon (assuming your doc is private practice). Your doc has agreed to accept $42 for those x-rays. He can charge a million bucks, he’ll still only get $42. The ER has negotiated a higher rate – $138 regardless of what they actually charge.

So many reasonable explanations…thank you!

I definitely believe that the PT office could be under contract not to disclose payment rates, but I really think most of the issue was that the billing office couldn’t even look up my benefits correctly. There are so many Regence/BlueCross/Premera plans in the world. Rather than visit the website or call the provider service number on my insurance card (the reasonable approach), I discovered that the billing office was looking up my information for the wrong insurance company. They were looking at Regence of Washington’s website, not BlueCross of Illinois’s website. The insurance company doesn’t make it easy either. Even if the Regence of Washington’s benefits we were looking at were mine, it was still not clear which set of three possible PT benefits would have applied to me.

I’m not quibbling with paying more than the benefits I receive. I get the economics of how insurance has to work. I am, and will likely forever be, the healthy person who subsidizes people who can’t seem to take care of themselves or prefer to pop a pill than adjust their lifestyle. I was simply fascinated that even with a major trauma – my first after paying for health insurance for 38 years – that the insurance company can still make money on me this year.

Oh, also for point #1 – the amount paid per visit for PT changes depending on how long you were treated and what the therapist did. 30 minutes of stretching and strengthening? That’s different than, say, 15 minutes of stretching/strengthening and 15 minutes gait training. Did they apply a cold pack after? That tacks on an additional charge. Ultrasound? Another charge still. So day to day your charge can vary and your biller isn’t able to predict what your PT is going to do. I also wouldn’t say they “arbitrarily inflate” the bill. They charge what they feel their time is worth and the insurance company pays what they feel the PT’s time is worth. These numbers just happen to be vastly different typically.

“Arbitrarily inflate” were the exact words used by the woman in the billing office. Her words, not mine.

On a related note, assuming the services provided are worth what I’ve paid for them, my PT is about ready to become more valuable than my surgeon 😉

wow! your surgery was CHEAP! I think my MRI was about 1600, and I paid $400 out of pocket… surgery was over $33,000, and my PT visits require a $20 co-pay (60 max a year). I think I paid close to what you paid, about $2,500 total out of pocket. Thank God for insurance!

This whole insurance thing just blows my mind. And I’m really not sure that i agree with “thank god for insurance”. I just had ACL repair surgery 2 months ago (cadaver graft). The bills i have seen so far have been totally about $100,000. Im totally serious – this is what was submitted to my insurance company and of course what they allow is a small fraction of this amount – i am sure the surgeon is well aware of the range they are actually going to collect … They arent stupid and if couldnt get enough to make a good profit, wouldnt they just not accept my insurance company? So the amount they are allowingnis in the range of 5000 or 6000 and i’ll be responsible for some chunk of this. I just think the whole insurance deal is a scam. Im also relatively healthy (like Cary) and i am paying tens of thousands of dollars in premiums to cover myself and my family over all of the years ive been working. The insurance companie are making tons of money! Ive always thought it would be better if you could go to a doctor, with no insurance, and say hey, just give me a fair proce for medical service … The same price that you get paid from insurance companies.

it just depends on the insurance, doctor, hospital, deductible, etc… you could literally fly out of the country, get the surgery done, and still pay less than what you would have paid in the US. It is pretty ridiculous, so it’s always good to weigh your options and make the best decision with what is available! I had to go back and forth with my insurance in order for them to cover more of the expenses, never hurts to push back 🙂 I hope you are healing well from your surgery ❤